What Dealers Can Expect from the New and Used Car Markets in 2023

How long will the high demand and prices last? Read on to find out what dealers can expect in 2023 for inventory, pricing, and other new and used car...

Special Edition: ZeroSum Dealers' Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand trend data to automotive marketers and dealers. ZeroSum uses predictive modeling to accurately estimate new vehicle inventory, pricing trends, and market share.

A lot has changed in the automotive industry in 2022, and ZeroSum has tracked it all. From inventory and pricing trends to future predictions, this report provides everything auto dealers need to know to better understand 2022 trends and prepare for a successful year in 2023.

2022 Top Trends:

Quick-Access:

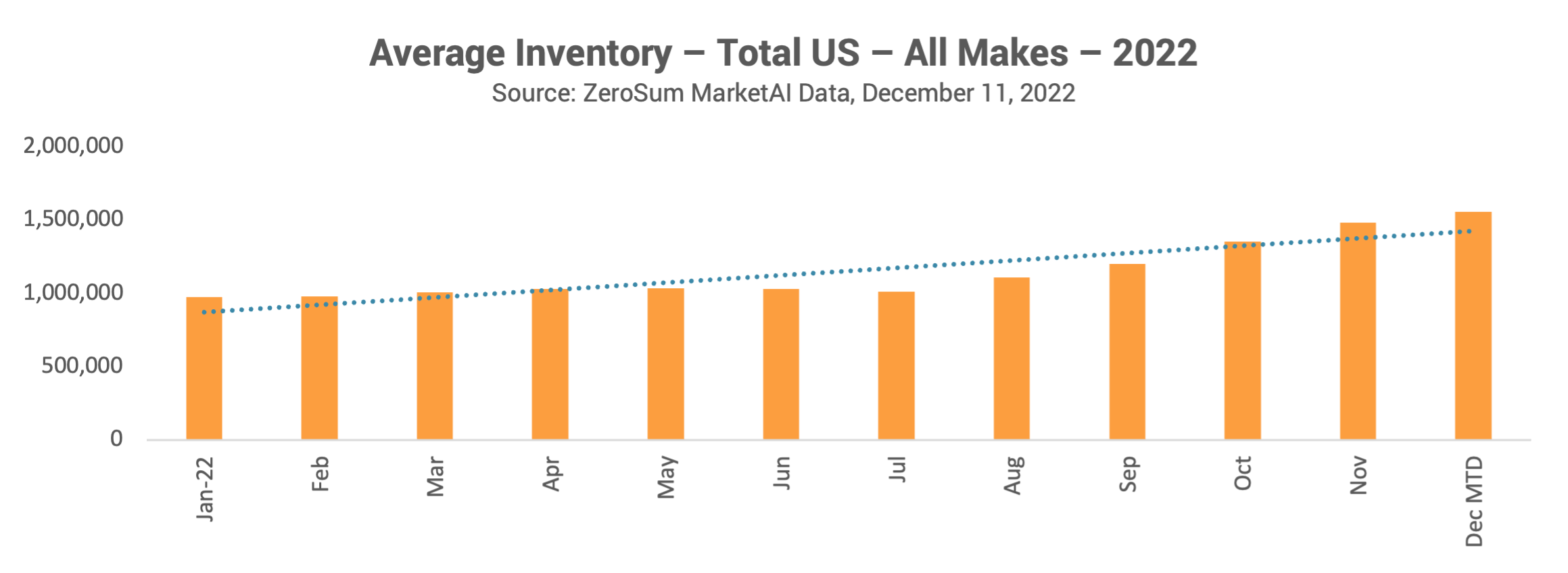

Since the pandemic began, low inventory has been a concern for auto dealers. However, since August 2022, inventory levels have been steadily on the rise, now up 59% since January. By the end of December 2022, ZeroSum forecasts that there will be 1,669,952 available new vehicles and 1,526,639 available used vehicles. Although this is still below pre-pandemic levels, it represents a shift in the right direction.

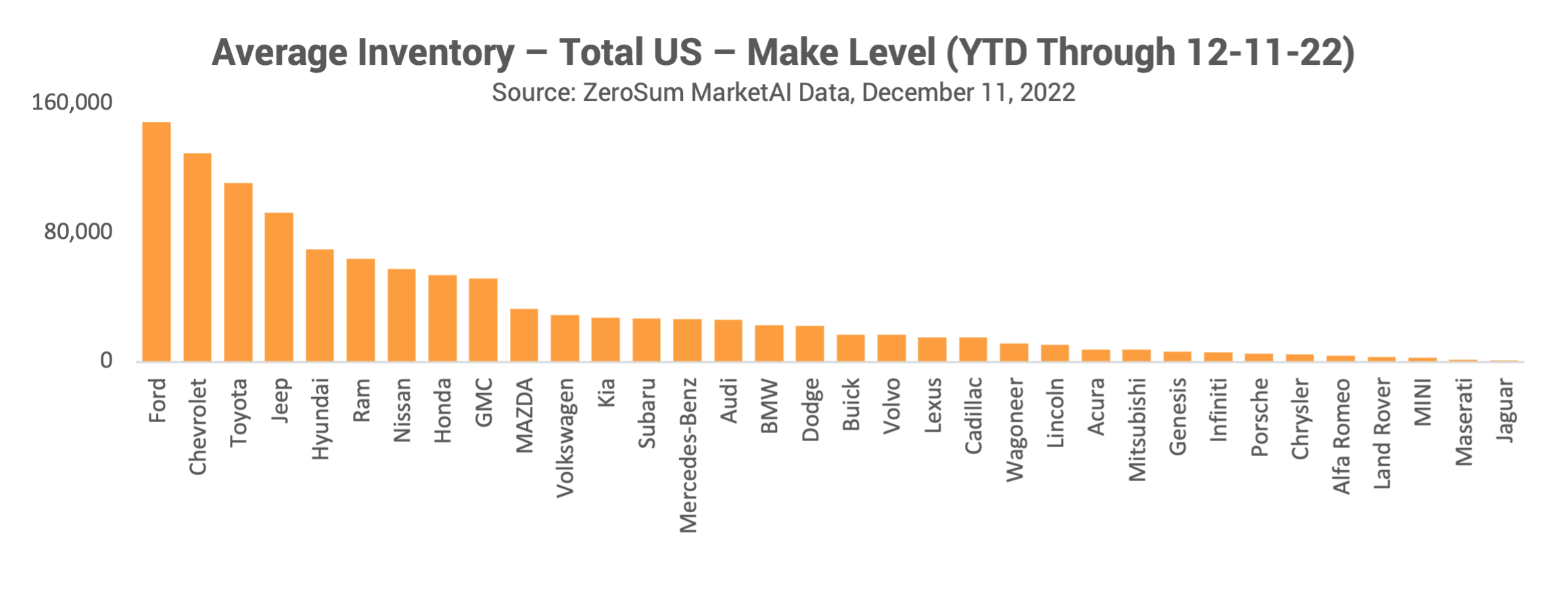

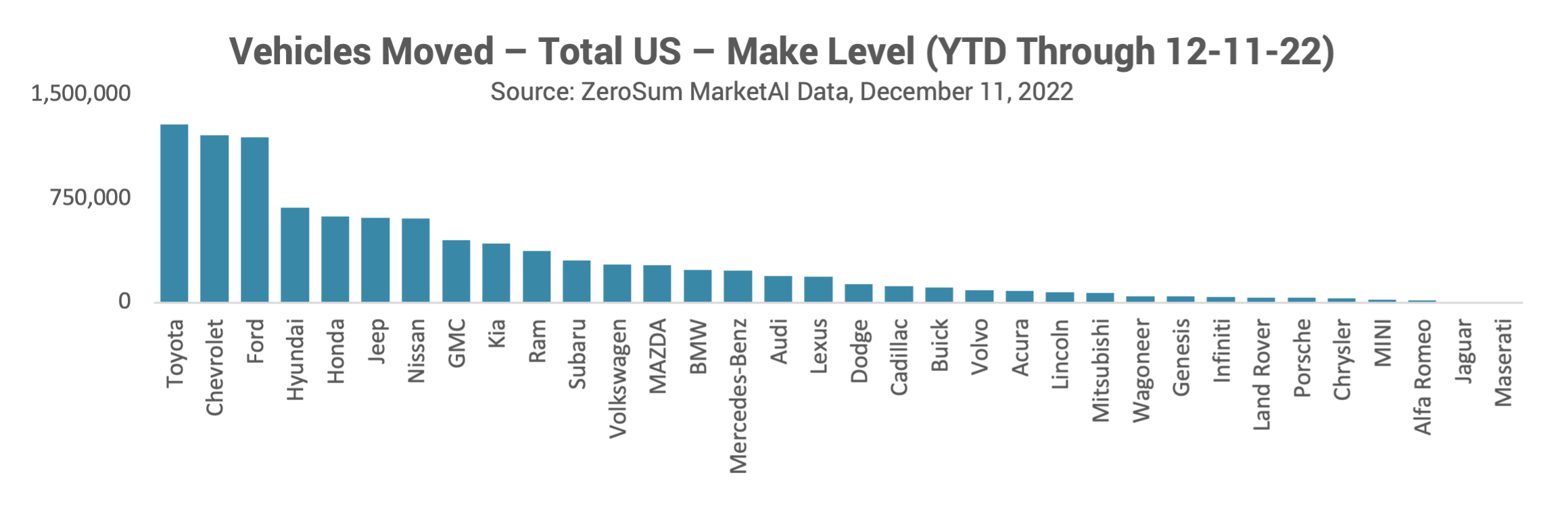

Only four brands improved their average inventory position in 2022. Genesis was up 44%, followed by Alfa Romeo, GMC, and MINI. Meanwhile, Acura and Honda were hit the hardest, with decreasing average inventory of 64% and 61% respectively. Ford and Chevrolet had the most average inventory overall for the year. No brands were able to increase both average inventory and turn rate. For OEMS, General Motors weathered the inventory storm best with a 17% gain for GMC and only a 4% loss for Chevrolet and a 12% loss for Cadillac. Buick was hit the hardest, dropping 51% YoY.

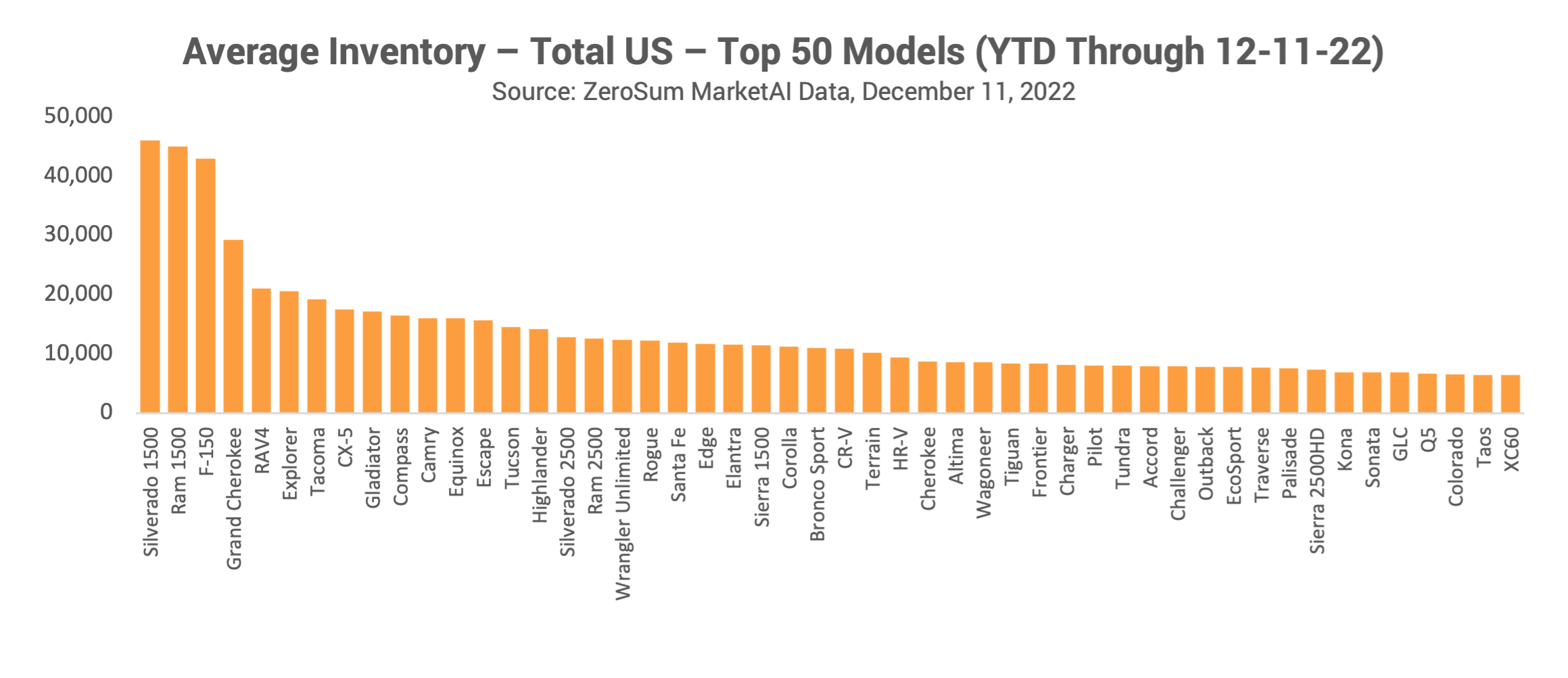

The three top models in terms of average inventory were the Chevy Silverado 1500, the Dodge Ram 1500, and the Ford F-150, all full-size pickup trucks. Models that were hit hardest in terms of Average Inventory declines were from Japanese or Korean manufacturers: Honda (CR-V, Accord, Pilot, HR-V), Toyota (Corolla), Nissan (Rogue), and Hyundai (Sonata, Kona).

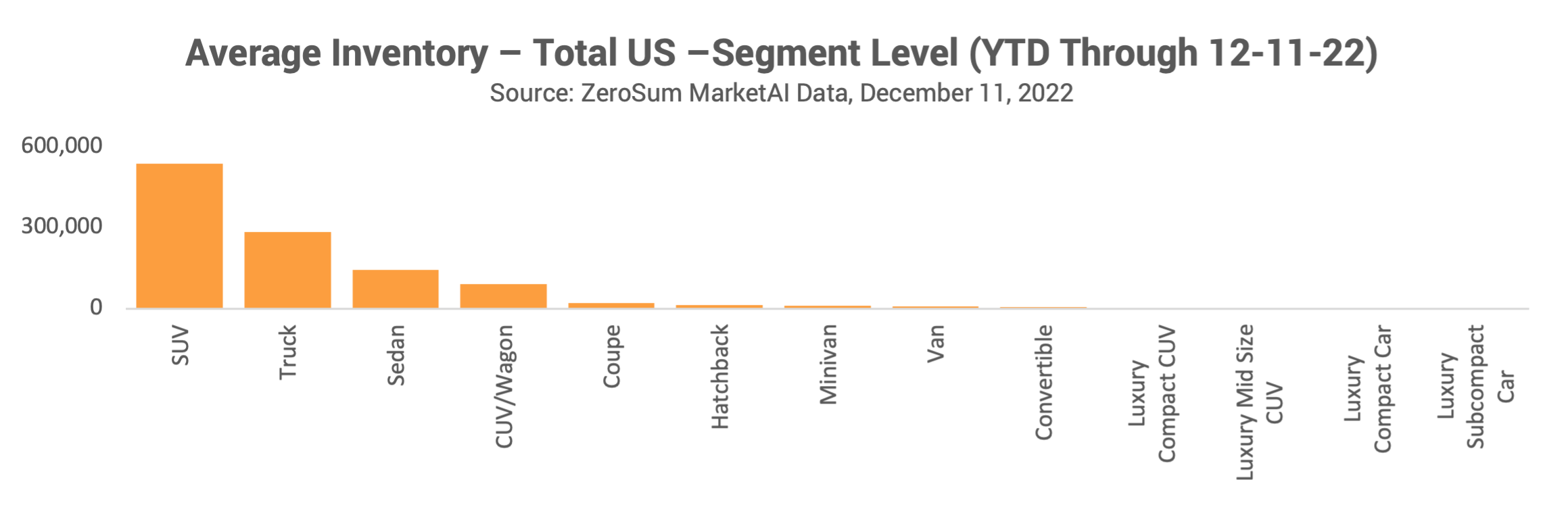

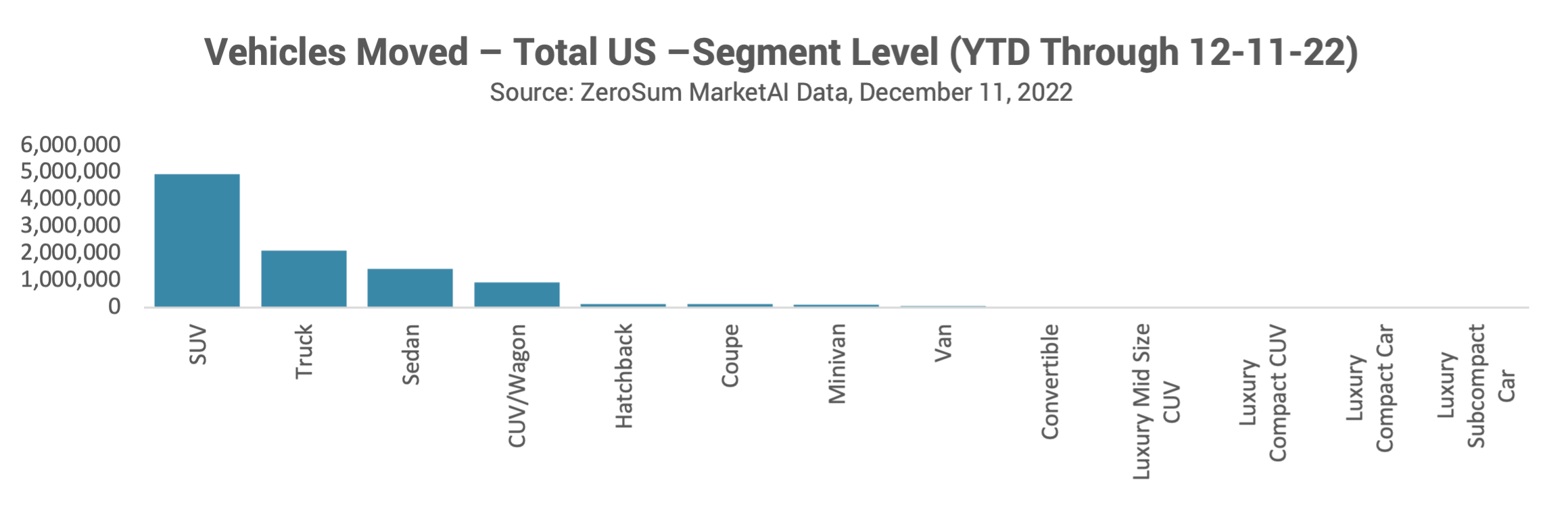

In terms of vehicle class, SUVs dominated in average inventory, with almost double the amount as Trucks. However, Trucks and Convertibles were the only segments to see increases in average inventory in 2022, gaining 6% and 3% respectively.

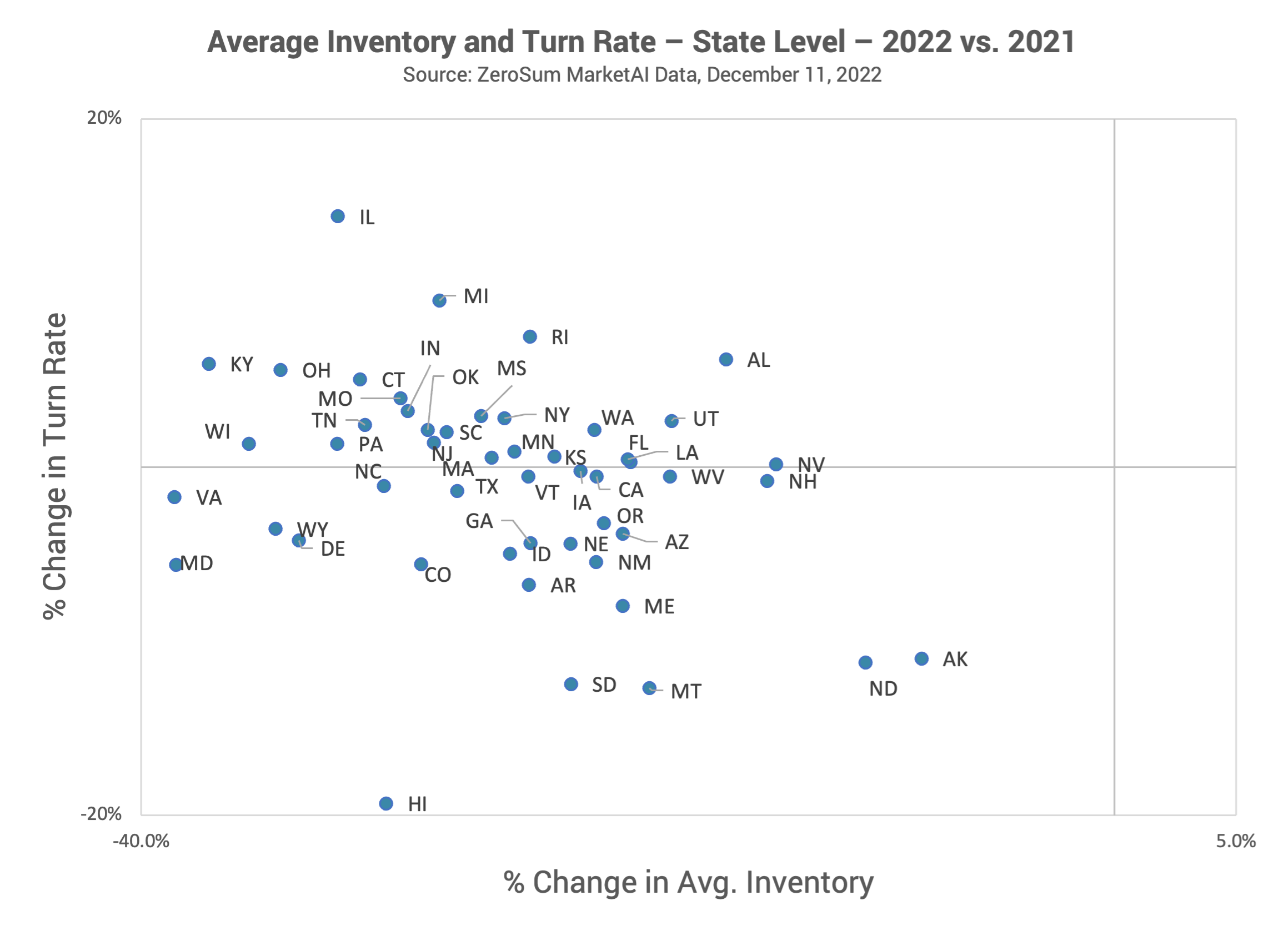

Geographically, no states saw an increase in average inventory for the year, with every state but Alaska experiencing a double-digit decline.

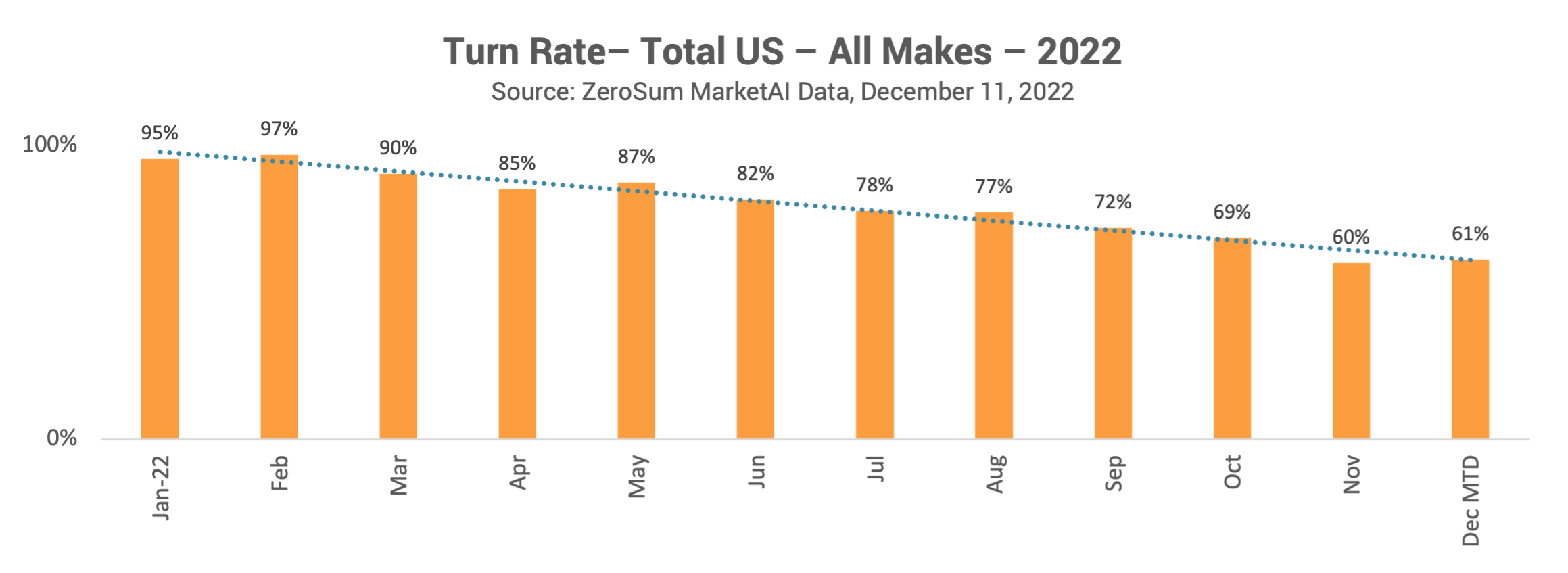

While inventory has been rising, turn rates have been falling, resulting in days supply improvements as the year has progressed.

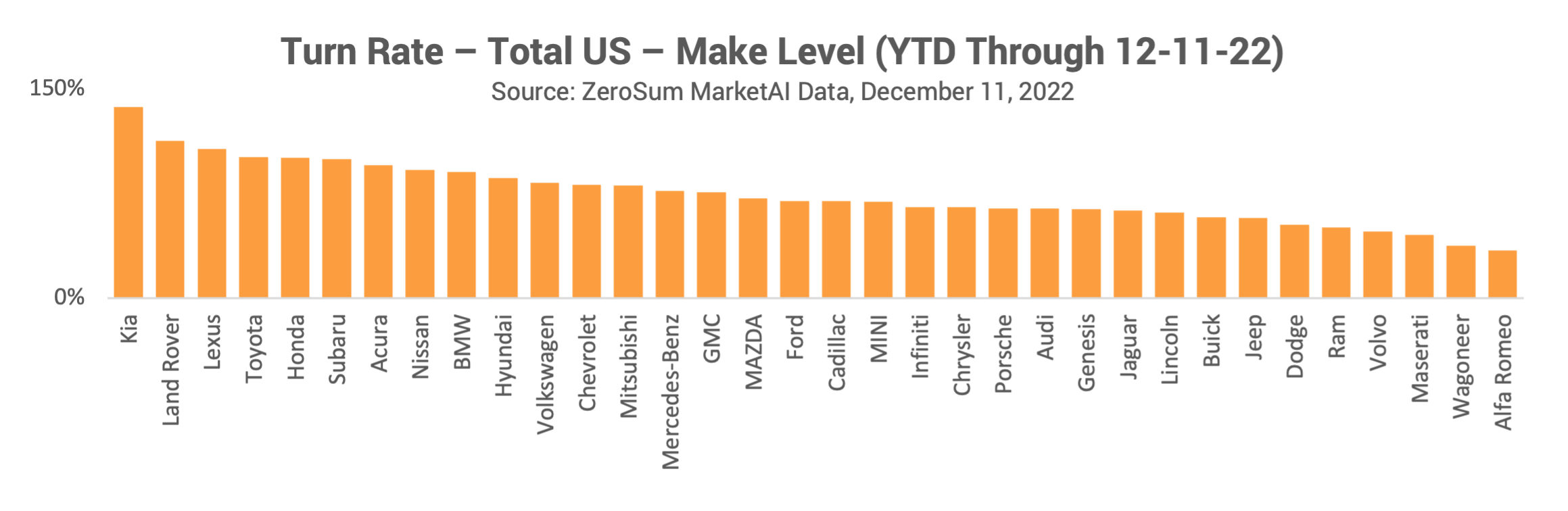

Kia, who was 12th for average inventory, had the highest turn rate of any brand at 137%, followed by Land Rover and Lexus. Toyota had the 6th highest turn rate, but placed first in total vehicles moved, beating out Chevrolet and Ford who were close behind.

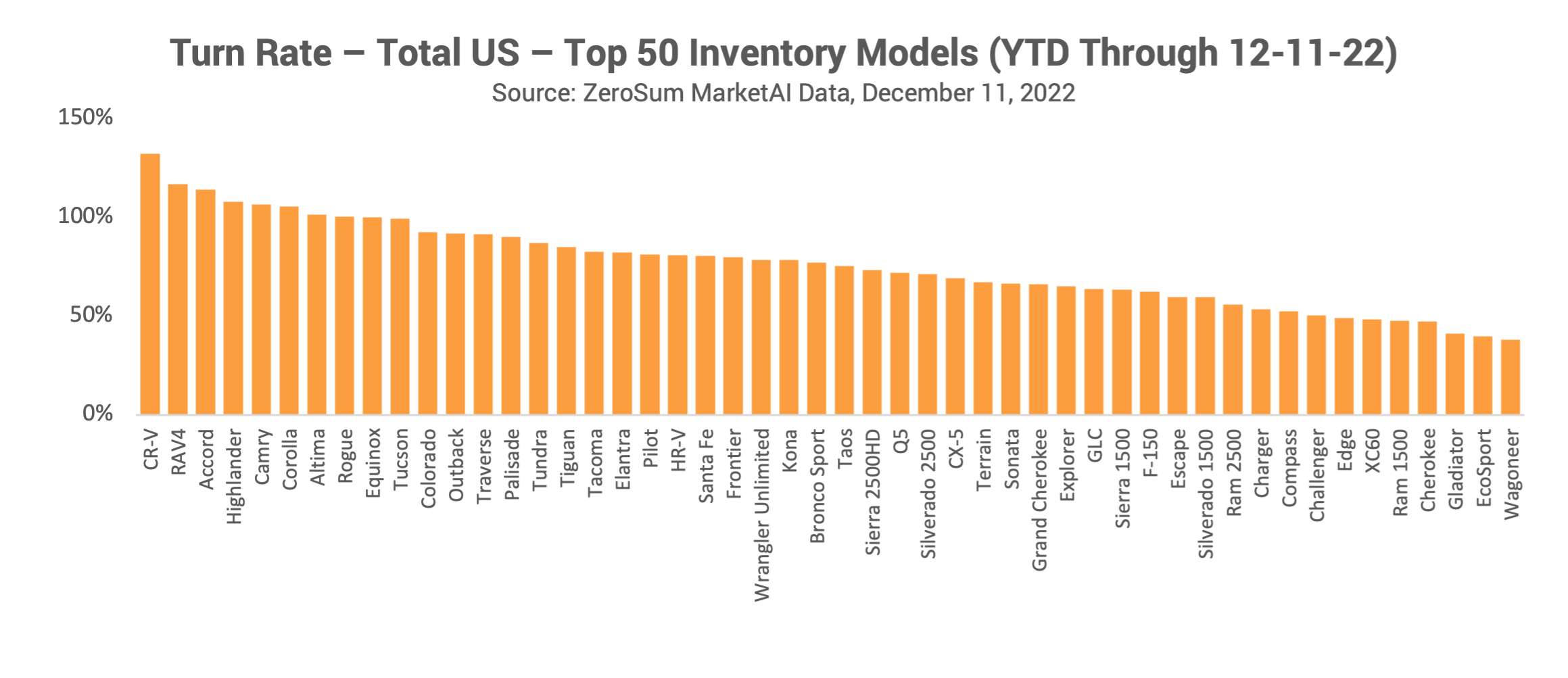

The top three models in terms of turn rate were the Honda CR-V, the Toyota RAV4, and the Honda Accord. The Jeep Compass, GMC Terrain, and Nissan Frontier were the only Top 50 models that saw increases in both average inventory and turn rate.

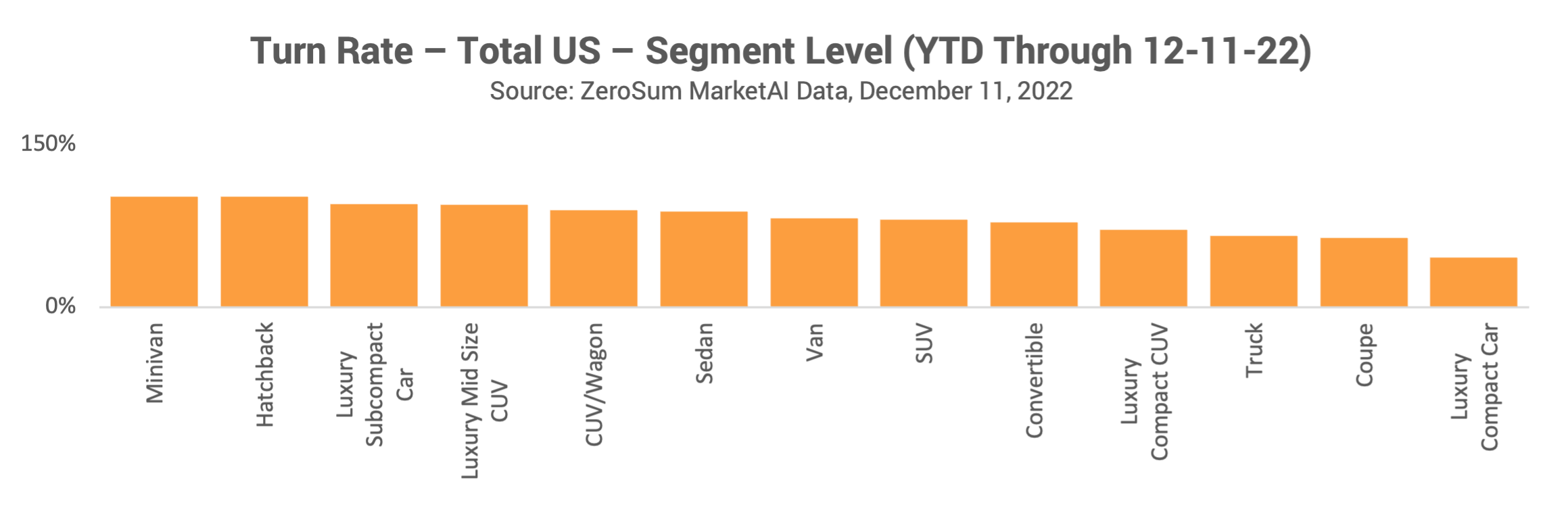

Despite having a relatively low turn rate, the SUV segment still moved the most vehicles overall, selling more than twice as many as Trucks. The Truck and Convertible segments were the only ones with increased average inventory for the year, but their turn rates declined by 25% and 21% this year while most other mainstream segments improved. Regionally, the Midwestern states had the most improvement in turn rate in 2022.

Despite having a relatively low turn rate, the SUV segment still moved the most vehicles overall, selling more than twice as many as Trucks. The Truck and Convertible segments were the only ones with increased average inventory for the year, but their turn rates declined by 25% and 21% this year while most other mainstream segments improved. Regionally, the Midwestern states had the most improvement in turn rate in 2022.

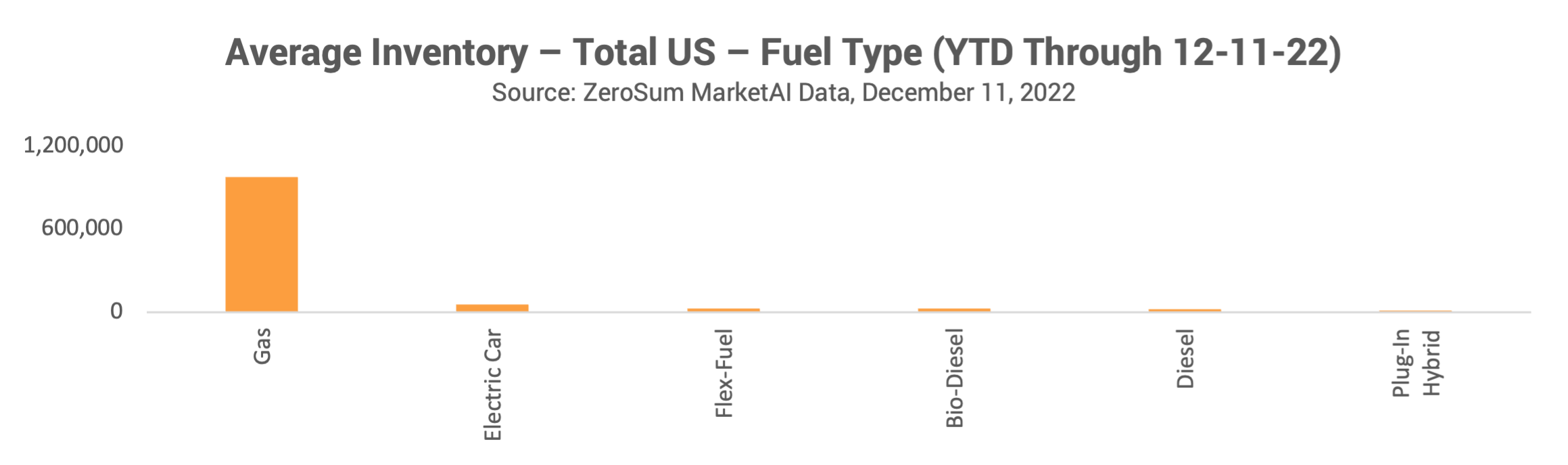

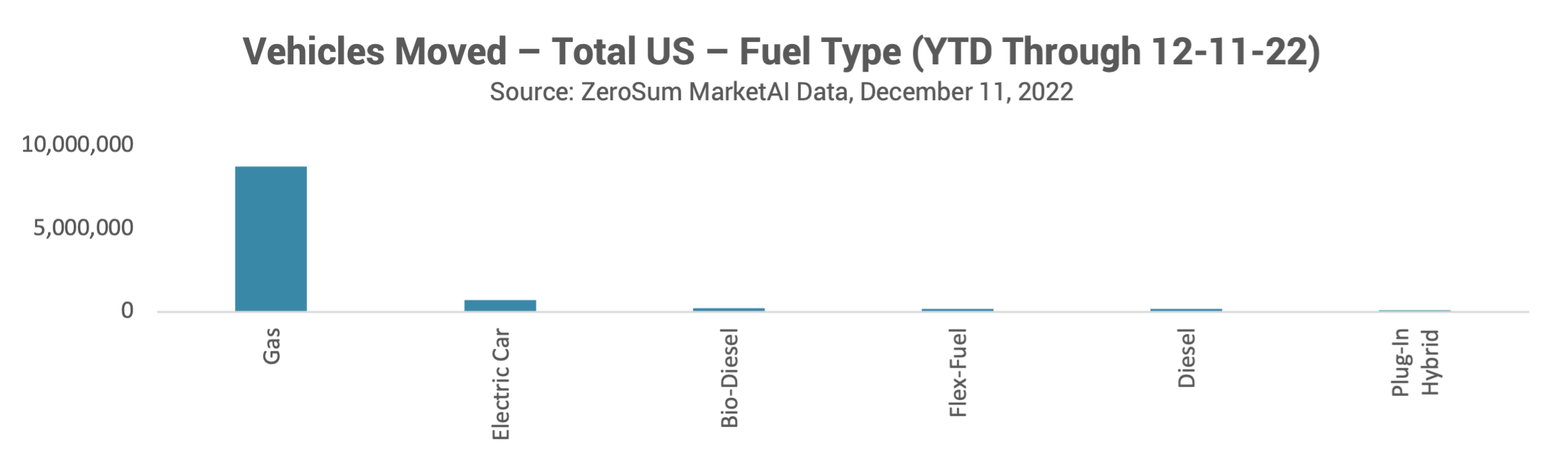

Internal Combustion Engine (ICE) vehicles dominated the automotive landscape in 2022, accounting for 87% of average inventory and 86% of vehicles moved (note that Tesla is underrepresented due to it not having traditional dealer locations or websites).

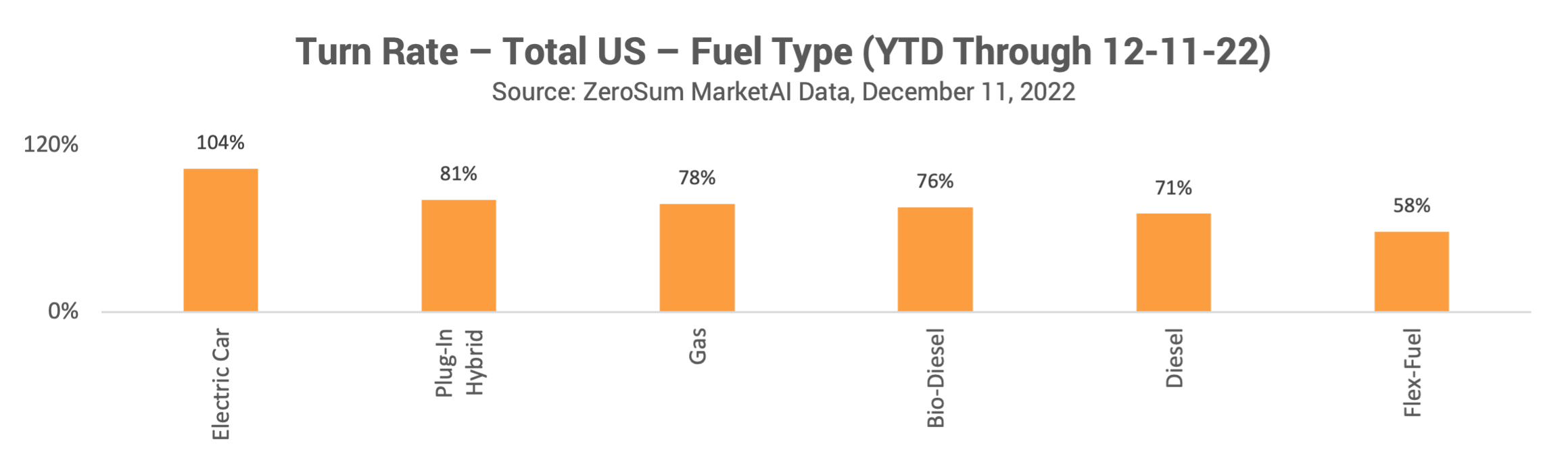

With volatile gas prices throughout the year that reached over $5/gallon, electric vehicles stood out in terms of turn rate, improving by 16% since 2021.

Barring any further unforeseen supply chain disruptions (e.g., a reoccurrence of a highly virulent COVID strain), inventories are expected to slowly recover over the course of 2023 but not approach pre-pandemic levels in the moderate (or perhaps even distant) future.

One residual effect of the original chip shortage and broader supply chain disruptions is that OEMs are moving from a purely “Just-in-Time” component philosophy to one that is more of a blend of “Just-in-Time” with “Just-in-Case” for parts that are critical to manufacturing completion. Broader adoption of this approach will help mitigate severe shortages in the future, though its effects will not take hold until inventories return to levels that overcome the current disequilibrium between demand and supply.

While there will continue to be pent up demand for some segments and makes, there are others that have already overcome the imbalance between supply and demand. In particular, the Truck segment, which became the focus of inventory allocations for those OEMs that have them, saw slowing turn rates in 2022 that signal more of a shift towards oversupply. The Sedan segment, on the other hand, will see pent up demand continue into 2023 as short supply and volatile fuel prices will allow them to be bought as fast as they can be manufactured and delivered.

Another implication of volatile fuel prices will be the continued focus on and interest in electric vehicles. Although this is true, it is important to note that ICE vehicles will continue to be the dominant fuel type for years to come, currently representing 86-87% of average inventory and vehicles moved.

ZeroSum’s Market First Report is based on ZeroSum’s retail vehicle movement and pricing indices, powered by real-time data gathered using ZeroSum’s data-driven marketing platform MarketAI. The platform brings together vast amount of data, including all available light vehicle inventory in the U.S., to help improve marketing performance. MarketAI allows dealers to analyze their market in real-time, using sales conversion rates, market turn rates, days’ supply, and competitive inventory.

ZeroSum is a leader in software, marketing, and data. Powered by its SaaS platform, MarketAI, ZeroSum is simplifying and modernizing automotive marketing by leveraging artificial intelligence, data, and scaling ability to acquire new customers. ZeroSum is the first and only company that matches consumer demand with automotive data in real time. For more information, visit https://www.zerosum.ai/.

For media inquiries, please contact ldagg@zerosum.ai.

Download a free copy of the ZeroSum Market First Report and receive the most recent automotive trends monthly!

How long will the high demand and prices last? Read on to find out what dealers can expect in 2023 for inventory, pricing, and other new and used car...

The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand...

The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand...