The Fastest Moving Vehicle Segments? It Might Surprise You

Segment Dynamics Require a Multi-Faceted Approach From Dealers

2 min read

ZeroSum May 12, 2023

The global microchip shortage that gripped the auto industry in recent years caused many manufacturers to relive their college Economics 101 lessons. Namely, tighter supply drives up prices and yields higher profits on a per vehicle basis.

Even though inventories are making a comeback, It’s unlikely automakers will ever go back to a strategy of having a three-month backlog. They are much more likely to keep inventories at lower levels and ring out as much profit per vehicle as they can.

Higher profits are obviously great for manufacturers, dealers and investors alike. But, for consumers? As Bloomberg News reported in February, “New cars are only for rich folks now…”

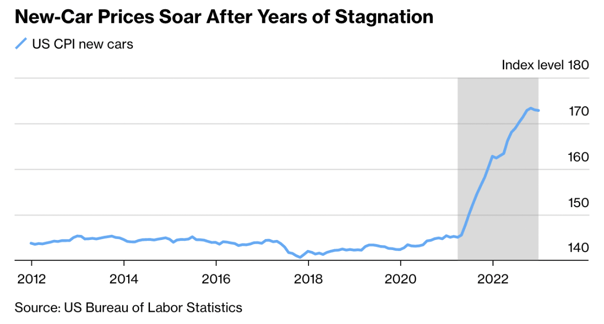

The evidence backs up that claim. The average monthly payment for a new car has soared to a record $777, nearly doubling from late 2019, according to Kelley Blue Book owner Cox Automotive. That’s almost a sixth of the median after-tax income for US households. Even used models have climbed to $544 a month on average.

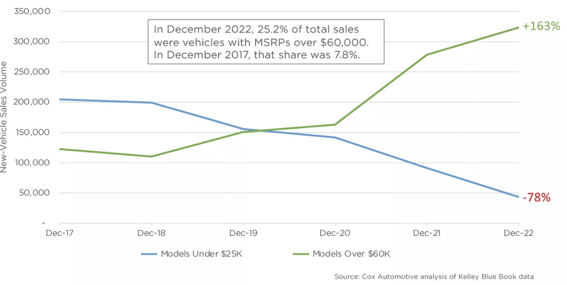

The average price for a new vehicle in the US has jumped to almost $50,000, up 30% since 2019, according to JPMorgan. Prices have retreated somewhat, according to Bloomberg, but the pullback isn’t enough for most consumers to comfortably buy a new car; they simply don’t have much choice. The number of affordable models available has dwindled. In 2017, buyers could choose from 36 models that cost less than $25,000. In 2022, they had just ten such options.

There has been a corresponding boom in expensive vehicles as well. The number of vehicles sold with MSRPs over $60,000 has more than tripled. In 2017, vehicles over $60,000 accounted for 7.8% of the market share. By December 2022, that share grew to 25.2%.

As vehicle prices have shot up, incomes have stagnated in the post-covid era. In fact, according to the US Census Bureau, real median household income fell from $72,808 in 2019 to $70,784 in 2021. The level of staggering vehicle growth, combined with stagnating incomes, will certainly push some customers out of the new vehicle market.

How will this impact dealers? Traditional customer groups are likely to change. Prospects who would have been a lock for a new car just a few years ago are much more likely to purchase used. A traditional Certified Pre-Owned customer might opt for an older model used vehicle in the 3–5-year-old range or even the 5–7-year-old range.

The key for dealers will be to quickly figure out which customers and prospects now are most likely to fit into each category. The market has shifted so quickly that even experienced dealers can no longer rely on their own market knowledge or listening to their gut.

They need a secret weapon, and that’s where Market AI comes into play.

Market AI matches inventory data to insights collected from a variety of customer touchpoints across the platform. Once we marry these two together, we can match the right inventory to the right customer. Simply put, if the dealer is trying to sell a $60,000 vehicle, our AI and Machine Learning can help maximize the campaign by matching up with customers who recently searched for a similarly priced vehicle. If the dealer is trying to sell Explorers, we match them to customers looking for vehicles such as a Highlander, Traverse, or Acadia, for example.

As vehicle inventories stay tighter than historic levels, it will be more important than ever to match the right vehicle to the right customer. Economic factors are quickly changing which customers buy which vehicles and using Market AI can keep dealers one step ahead.

Segment Dynamics Require a Multi-Faceted Approach From Dealers

The automotive world moves fast. AI this, technology that, digital transformation everywhere you look. But here's what decades in this business have...

By Jeff Englishmen, VP of Dealer Success at ZeroSum Consumers have many choices to make when buying a car: new or used, lease or buy, features and...