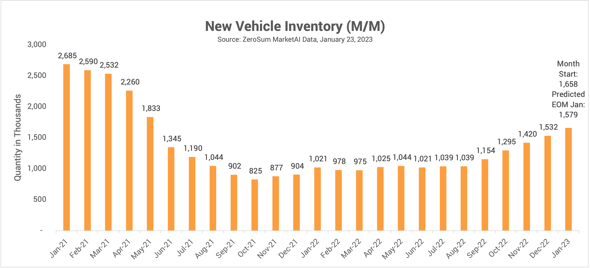

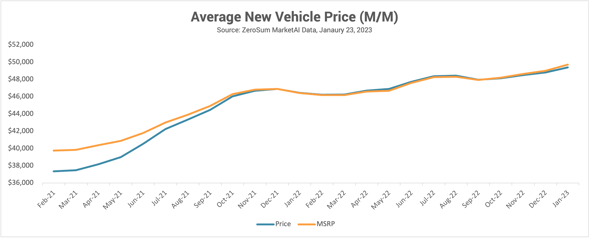

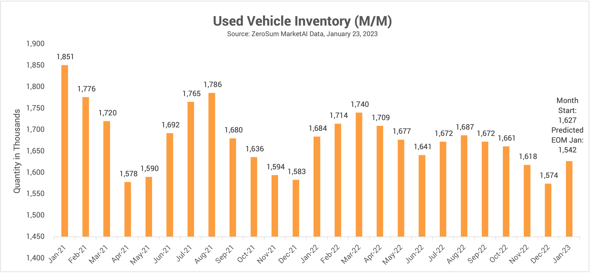

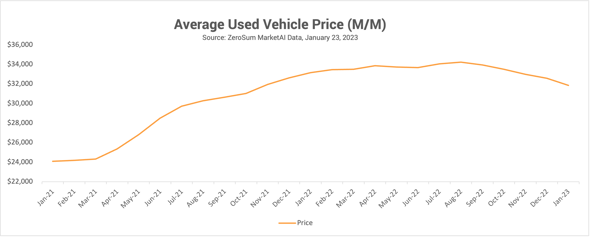

ZeroSum Market First Report March 2023: New Vehicle Inventory Still Climbing as Used Inventory Predicted to Reach New Low

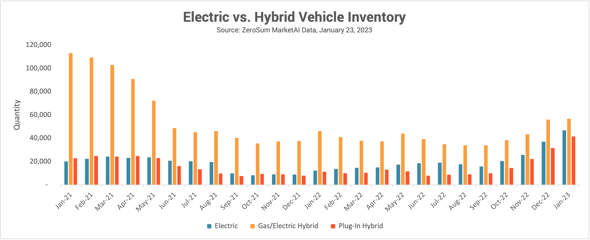

The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand...