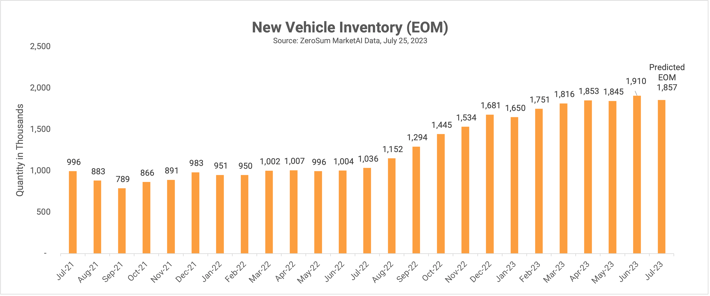

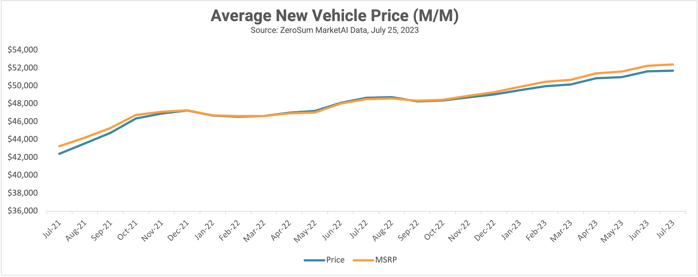

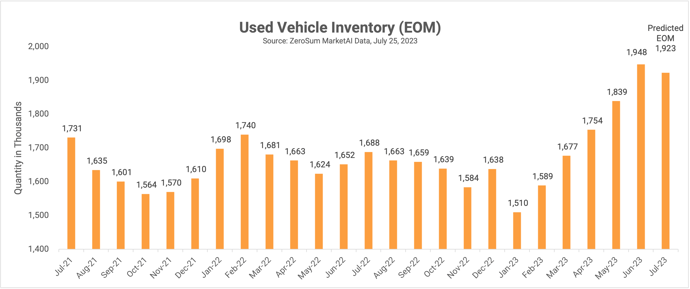

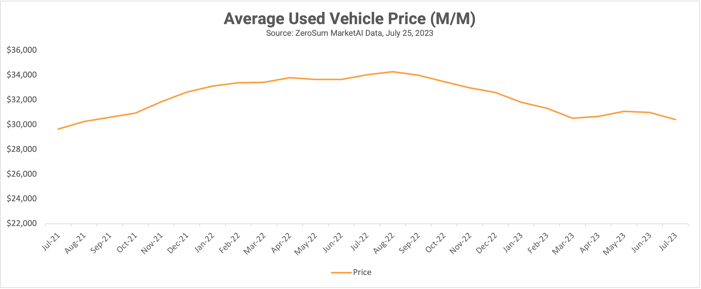

ZeroSum Market First Report September 2023: New Car Inventory Has Reached a New Two-Year High; Used Vehicles Average Price Below $30,000 for the First Time in Two Years

The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand...