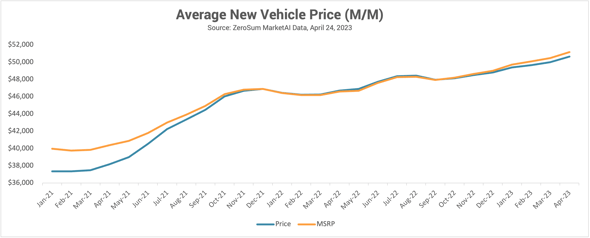

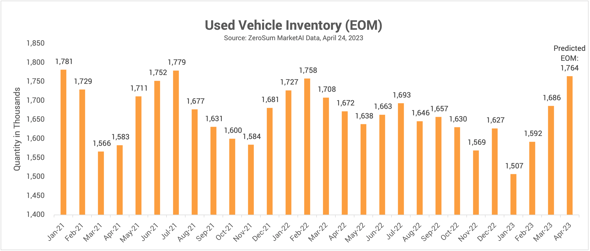

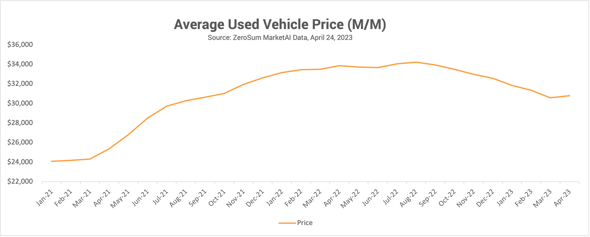

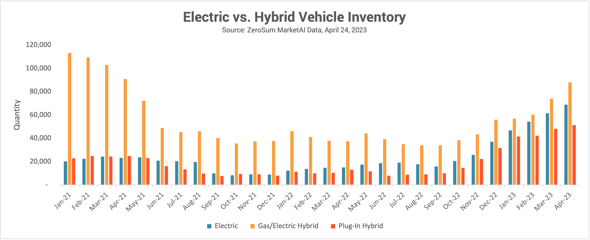

ZeroSum Market First Report June 2023: Despite a Small Bump in New Car Inventory, Prices Remain Historically High

The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand...