New Car Inventory Declines (Slightly) For the First Time in Two Years

Selling Conditions Remain Competitive Across New, Used, and Certified

3 min read

ZeroSum October 26, 2023

The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand trend data to automotive marketers and dealers. ZeroSum uses predictive modeling to accurately estimate new vehicle inventory, pricing trends, and market share.

Quick-Access:

1. Summary: What You Need to Know

2. New Vehicles Retail Outlook

3. Used Vehicles Retail Outlook

4. Electric Vehicles Retail Outlook

The bigger picture of the automotive industry landscape has a direct effect on how dealers should make their decisions and manage their businesses. The dynamics of a given dealer’s actions on issues such as pricing, inventory allocation, and marketing spend should look to the macro-trends that provide context for those actions.

It is well understood that the last several years have been difficult to navigate, with multiple challenges to contend with. COVID, post-COVID recovery, chip shortages, broader supply chain issues, the UAW strike, and initial and accelerating inventory recovery are just some of the bigger events that have had a major impact on dealers across the country. The Market First report is designed to provide that bigger picture viewpoint and backdrop in which dealer decisions are made.

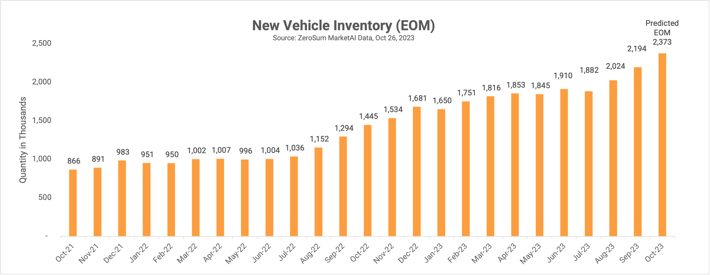

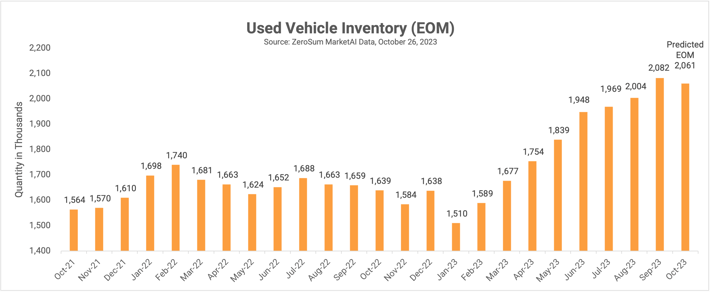

This month’s report focuses on a continuing rise in new car inventory, which has been accompanied by a gradual drop in new car pricing as supply has continued to recover. Meanwhile, on the used car front, inventory growth took a slight pause after eight months of continuous increases. Used car pricing continued to fall even with this month’s small dip in supply.

In both cases, the longer term trends are pointing to an environment in which dealers are having to work harder to sell individual vehicles even as the rebound in supply provides them with more inventory to meet consumers’ needs.

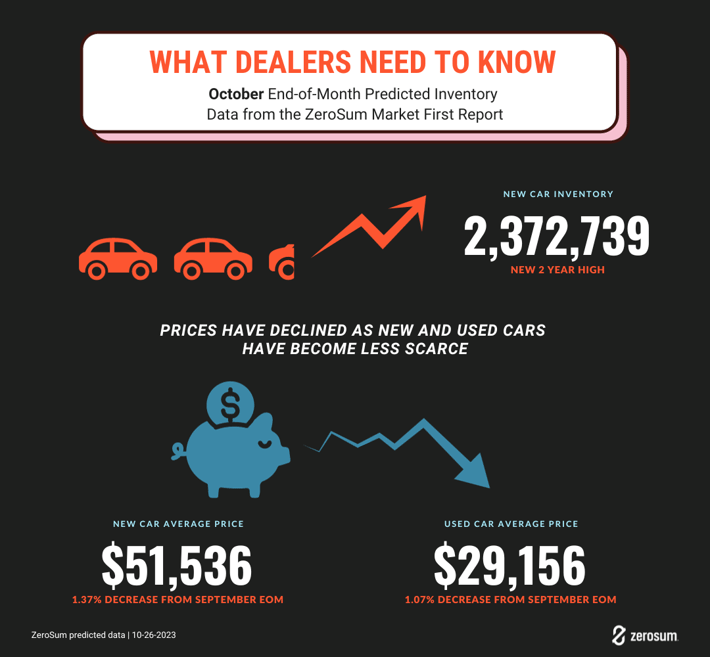

October’s new car inventory is rising, with EOM predicted to be 2,372,739.

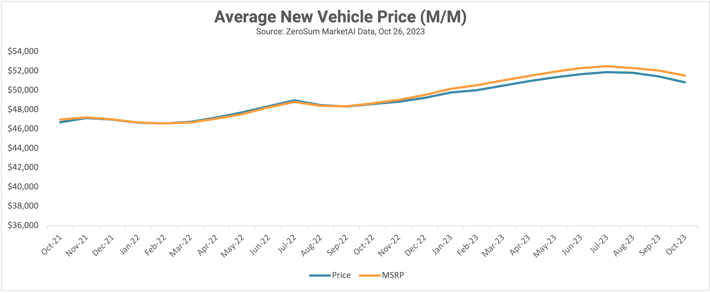

New car prices have dipped to $50,830, a decrease of -1.37% from September EOM, the third month in a row prices have dropped.

Used vehicle inventory is predicted to be 2,060,971 at EOM. This is a slight decrease from 2,081,560, - which was where inventory sat at the end of September - and used car prices have declined for the fifth month.

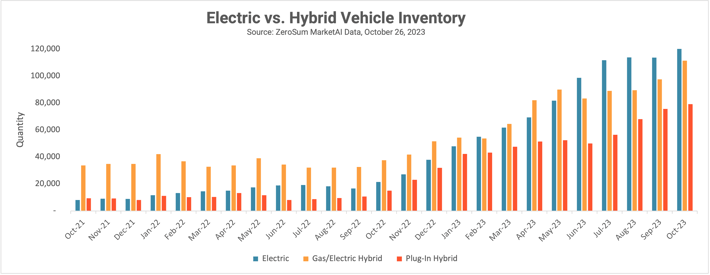

October 2023, total EV supply has increased to 311,424, with all three categories - electric, gas/electric hybrid, and plug-in hybrid - increasing inventory.

October’s new car inventory is continuing to rise, with EOM predicted to be at 2,372,739.

New car prices have dipped to 50,830, a decrease of -1.37% from September EOM. October marks the third month that new car prices have dropped. MSRP is, on average, $51,536, which widens the gap between MSRP and marketed price to $706.

ZeroSum can report that October EOM used vehicle inventory is predicted to be 2,060,971. This is a slight decrease from 2,081,560, where the inventory sat at the end of September. After the industry saw rapid increases in used inventory at the beginning of 2023, the past few months of small decreases appears to indicate that used car inventory could be leveling out.

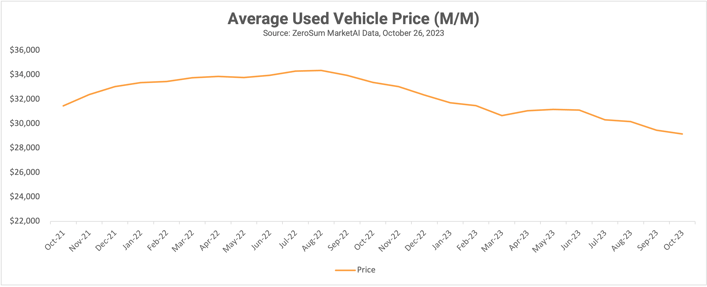

ZeroSum has reported that the price of used cars had decreased over the past four months, and October 2023 has kept up that trend and adds a fifth straight month. The average price of a used car is now $29,156, a -1.07% decrease from September EOM ($29,471). The decline in prices has generally coincided with the rebound in inventory as used cars have become less scarce.

Electric Vehicles Retail Outlook

October 2023 total EV supply has increased to 311,424, with all three categories - electric, gas/electric hybrid, and plug-in hybrid - increasing in inventory. September’s total EV inventory was 286,799, so the U.S EV inventory has grown 8.59% from September to October 2023.

After a small dip in pure electric inventory last month, October has shown an increase from 113,646 to 120,733, a MOM change of 6.24%. Gas/electric hybrid had a MOM change of 14.25%, with October inventory for that category now 111,480. The plug-in hybrid inventory for September is 79,211.

Data analytics firm Cloud Theory just released a report that covers the past, present, and future of the EV space. The report examines the current major players in the EV market, and poses the question, which OEMs are poised to thrive, survive, or disappear in this transformed world?

ZeroSum’s Market First Report is based on ZeroSum’s retail vehicle movement and pricing indices, powered by real-time data gathered using ZeroSum’s data-driven marketing platform MarketAI. The platform brings together vast amount of data, including all available light vehicle inventory in the U.S., to help improve marketing performance. MarketAI allows dealers to analyze their market in real-time, using sales conversion rates, market turn rates, days’ supply, and competitive inventory.

About ZeroSum

ZeroSum is an industry leader in software, marketing, and data. Powered by its SaaS platform, MarketAI, ZeroSum is simplifying and modernizing automotive marketing by leveraging artificial intelligence, data, and scaling ability to acquire new customers. ZeroSum is the first and only company that matches consumer demand with automotive data in real-time for elite dealer marketing efficiency. For more information, visit www.zerosum.ai.

For media inquiries, please contact mdevilling@zerosum.ai or rslotnick@cloudtheory.ai

Download a free copy of the ZeroSum Market First Report and receive the most recent automotive trends monthly!

Selling Conditions Remain Competitive Across New, Used, and Certified

1 min read

New State of the Dealer report provides US auto retailers with inventory, turn rate, days-on-lot, and vehicle pricing data and includes...

The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand...