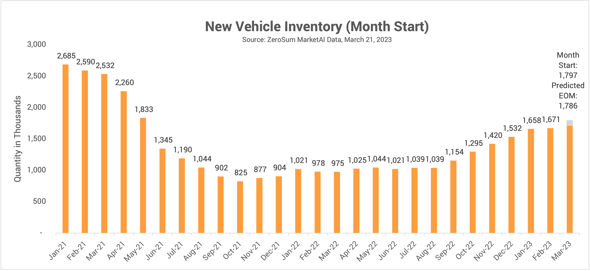

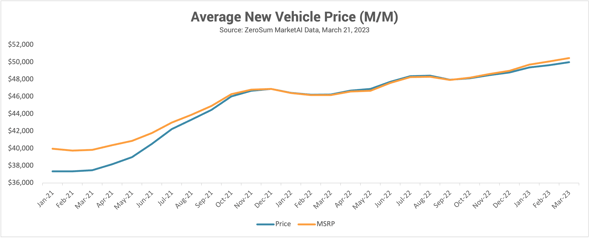

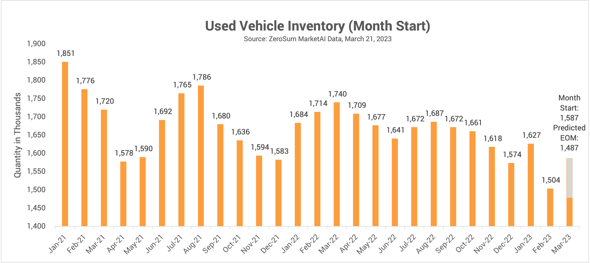

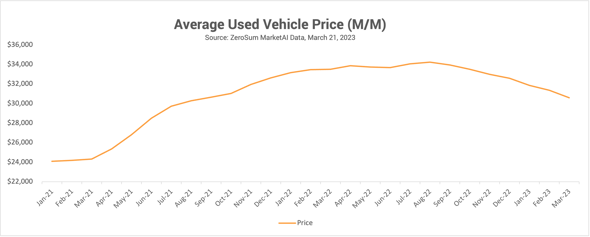

ZeroSum Market First Report November 2022: New Vehicle Inventory and Prices Rise as Used Vehicles Become Harder to Afford

The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand...