3 min read

ZeroSum Market First Report February 2022: Fewer New Vehicles In February Compared to 2021

ZeroSum

Feb 25, 2022 12:00:00 AM

The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand trend data to automotive marketers and dealers. ZeroSum uses predictive modeling to accurately estimate new vehicle inventory, pricing trends, and market share.

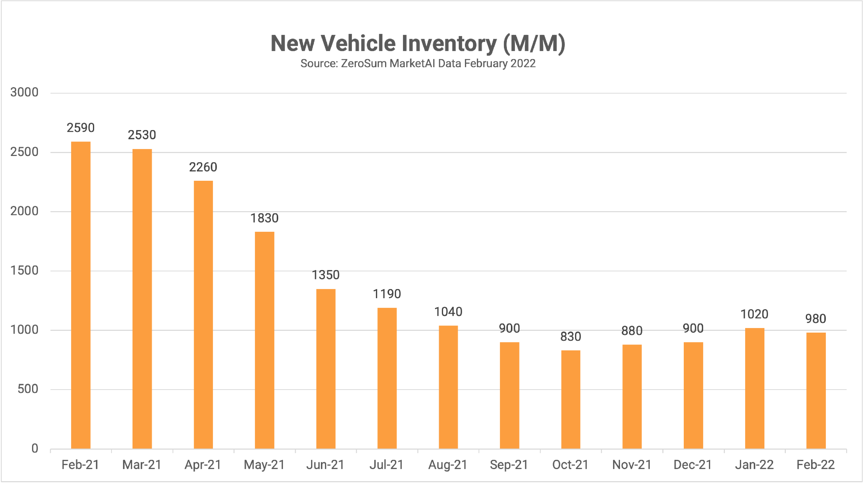

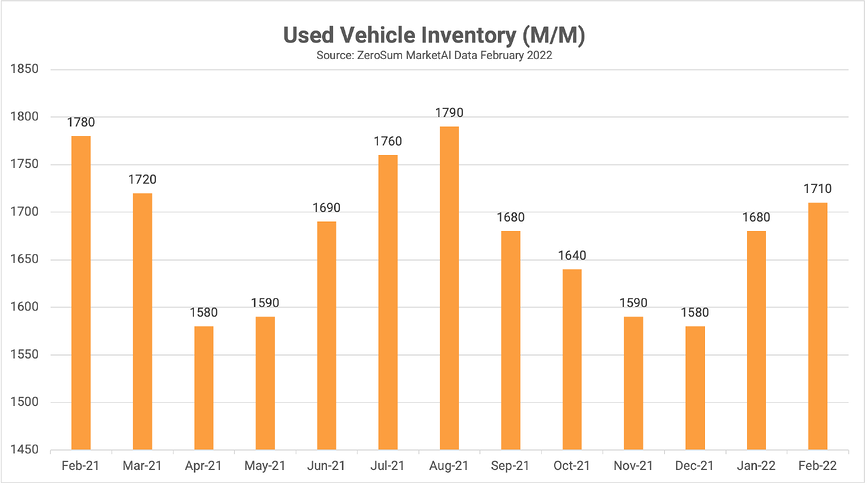

New and Used Vehicle Inventory

As inventory shortages have continued over the last two years, ZeroSum has been steadily monitoring the impact on the automotive industry. The month of February began with 4% fewer new vehicles on the ground than in January, a decrease of 42,957 units available for sale. When compared with 2021, the start of February 2022 is down 62% year-over-year, a decrease of over 1.6 million units. MAZDA had the largest increase in available new inventory, gaining over 45% month-over-month. Audi, Mitsubishi, and Jaguar also showed strong month-over-month gains despite the continued shortage of essential manufacturing parts.

While new vehicle inventory was down at the beginning of the month, used vehicle inventory increased 1.7% month-over-month, with an increase of 29,804 units available for sale. However, February 2022 used car inventory is still down 3.5% year-over-year. Audi showed the biggest gain in used vehicle inventory, adding 14.99% more used cars available.

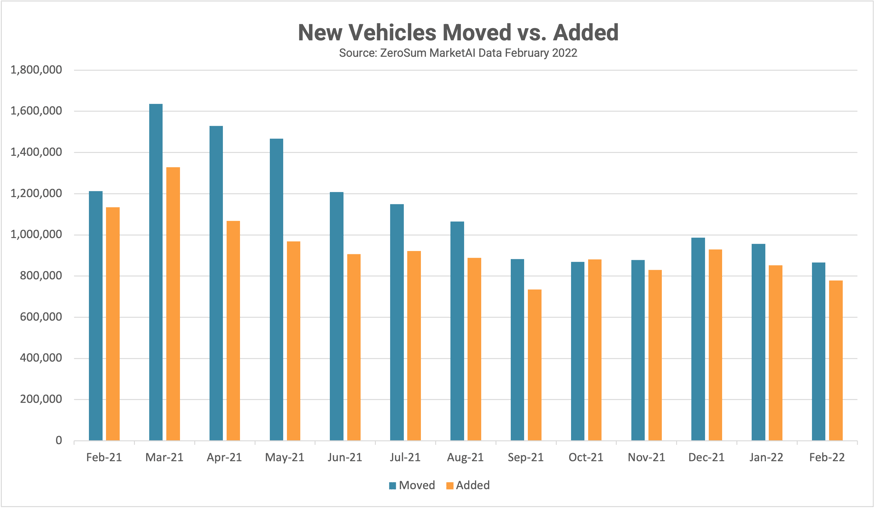

New and Used Inventory Movement

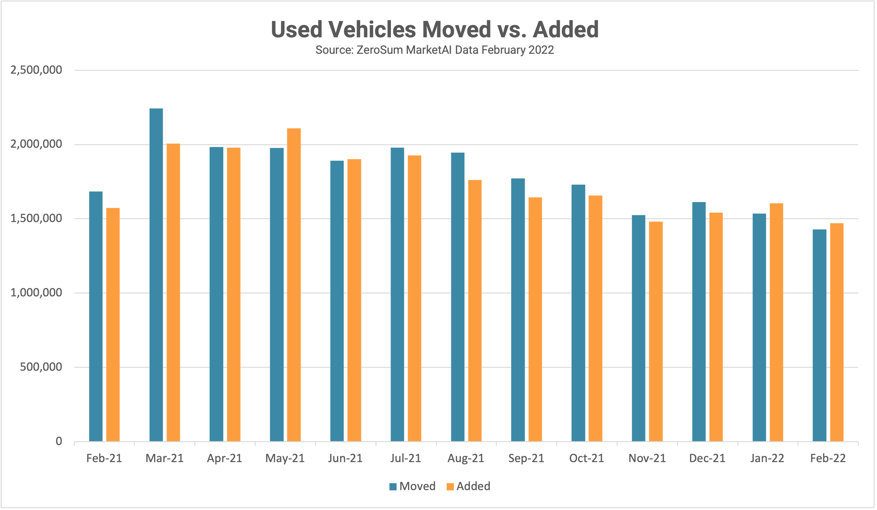

ZeroSum’s MarketAI platform tracks inventory as it leaves dealers’ lots in order to predict monthly sales outcomes. February is forecast to finish 9.5% below January in total new units sold and 7% below January in used units sold. MAZDA is positioned to make some of the biggest month-over-month new car sales gains while Audi is set to make some of the most used car sales gains.

Additionally, MarketAI tracks vehicles added to dealers’ inventory, in order to predict manufacturer production and overall inventory supply. 8.5% fewer new vehicles are forecast to be added to dealers’ inventory in February than January while 8.3% fewer used vehicles are forecast.

By combining inventory moved and inventory added, MarketAI also tracks turn rates of inventory across the industry. The average turn rate of new inventory is projected to be 88% in February, while used inventory turn rate is projected to be at 83%.

Automotive Pricing Trends

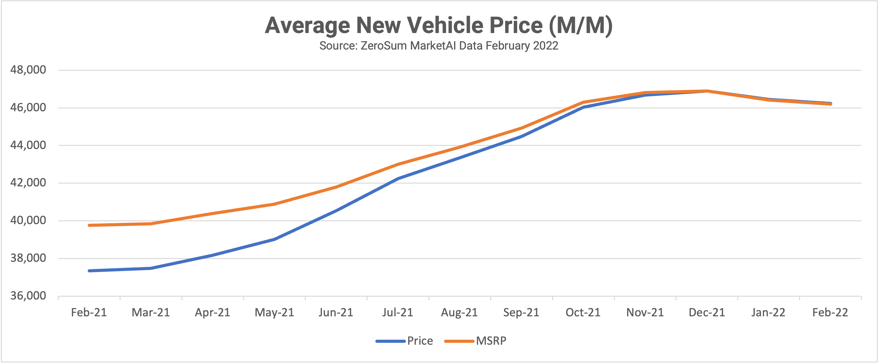

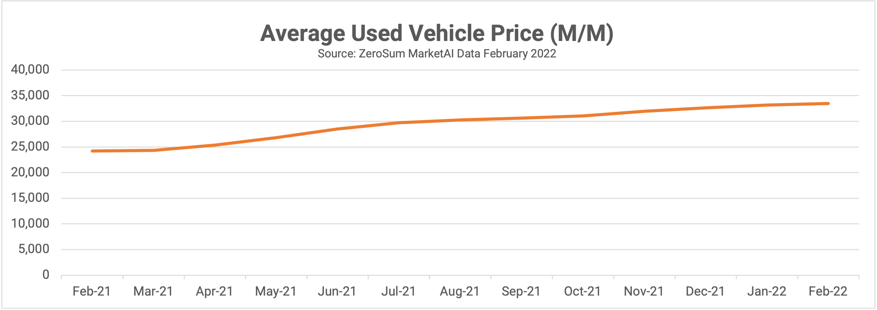

New vehicle prices have steadily risen as inventory levels have decreased. The average MSRP of a new vehicle is down half a percent in February compared to last month, but it remains up 16% over last year. Currently, list prices are averaging slightly higher than MSRP, whereas the average retail price was over 6% less than MSRP a year ago. Prices on used inventory continue to increase - up 1% month over month and up 38% year over year as constraints on new inventory drive used prices upwards.

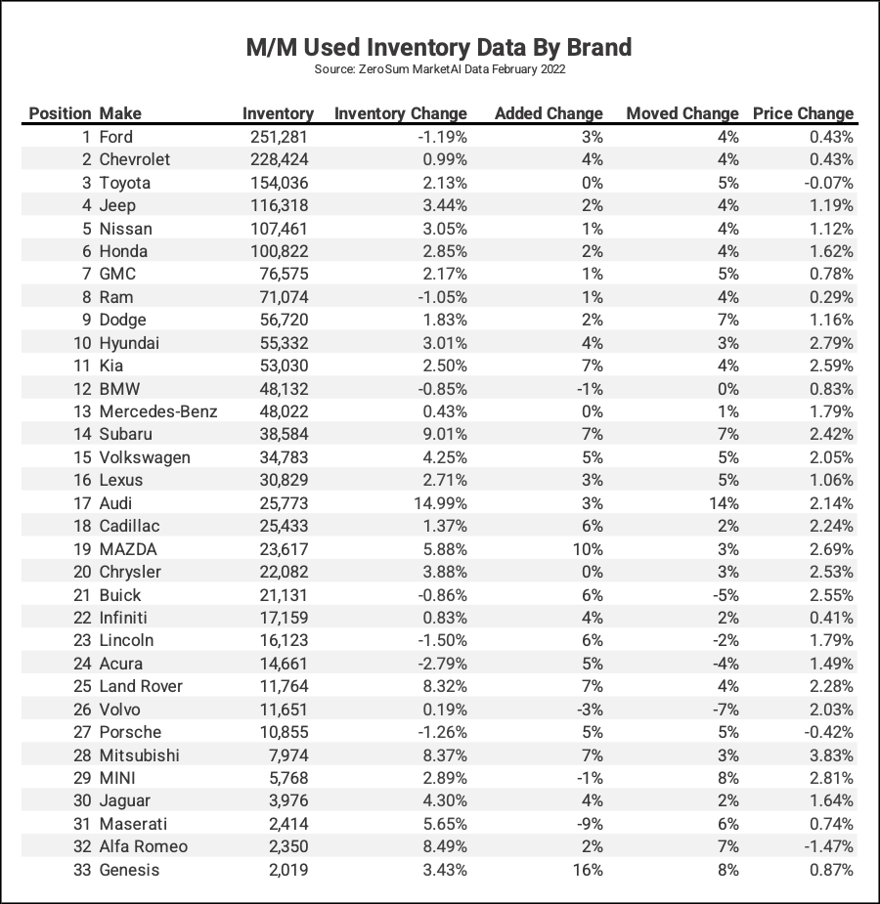

Inventory Data by Brand

ZeroSum also compiles inventory added, inventory moved, and price changes to show what is happening each month by brand. These brands are ranked in order from most to least available inventory. At the start of February, Ford displayed the strongest inventory levels for both new and used cars while Toyota, Chevrolet, and Jeep stayed close behind.

M/M Inventory Data by Brand Chart Definitions: 1. Position: rank based on highest amount of inventoryInventory: total vehicles in inventory at the start of this month. 2. Inventory Change: month-over-month increase/decrease in inventory compared to the first day of prior month. 3. Added Change: percentage increase/decrease of vehicles added to inventory this month compared to last month. 4. Moved Change: percentage increase/decrease of vehicles moved off dealers lots this month compared to last month. 5. Price Change: percentage change in average price from the end of the previous month.

About ZeroSum Market First Report

ZeroSum’s Market First Report is based on ZeroSum’s retail vehicle movement and pricing indices, powered by real-time data gathered using ZeroSum’s data-driven marketing platform MarketAI. The platform brings together vast amount of data, including all available light vehicle inventory in the U.S., to help improve marketing performance. MarketAI allows dealers to analyze their market in real-time, using sales conversion rates, market turn rates, days’ supply, and competitive inventory.

About ZeroSum

ZeroSum is a leader in software, marketing, and data. Powered by its SaaS platform, MarketAI, ZeroSum is simplifying and modernizing automotive marketing by leveraging artificial intelligence, data, and scaling ability to acquire new customers. ZeroSum is the first and only company that matches consumer demand with automotive data in real time. For more information, visit https://zerosum.ai.

Download a free copy of the ZeroSum Market First Report and receive the most recent automotive trends monthly