1 min read

ZeroSum State of the Dealer Report December 2023: The Automotive Landscape is Becoming More Competitive as New Car Inventories Grow and Demand fails to Follow

ZeroSum

Dec 6, 2023 10:19:38 AM

The ZeroSum State of the Dealer Report is the first and premier data source for the new, used, and certified pre-owned automotive market. ZeroSum serves as a crucial resource for automotive dealers, offering indispensable data on supply and demand trends and delivering unprecedented insights on inventory and 30-day forecasts on vehicle movement. State of the Dealer answers the question that all automotive dealers are wondering: "Is it going to be harder or easier to sell a car next month?"

ZeroSum’s State of the Dealer

ZeroSum's November data indicates a trend of heightened difficulty in selling cars across new, used, and certified vehicles. Dealers should carefully consider taking steps and using available tools to maximize demand for the inventory on (or in transit to) their lots, as well as evaluating the relative supply and demand in their local area in order to implement appropriate pricing adjustments and to inform negotiations with prospective buyers.

New Vehicles Retail Outlook

November witnessed a notable increase in inventory for new cars, jumping 8% to reach 2.48 million units compared to October's 2.30 million. Just two months after surpassing two million units for the first time in two years, new vehicle supply is accelerating as numerous OEMs strive to recover from post-COVID supply chain issues.

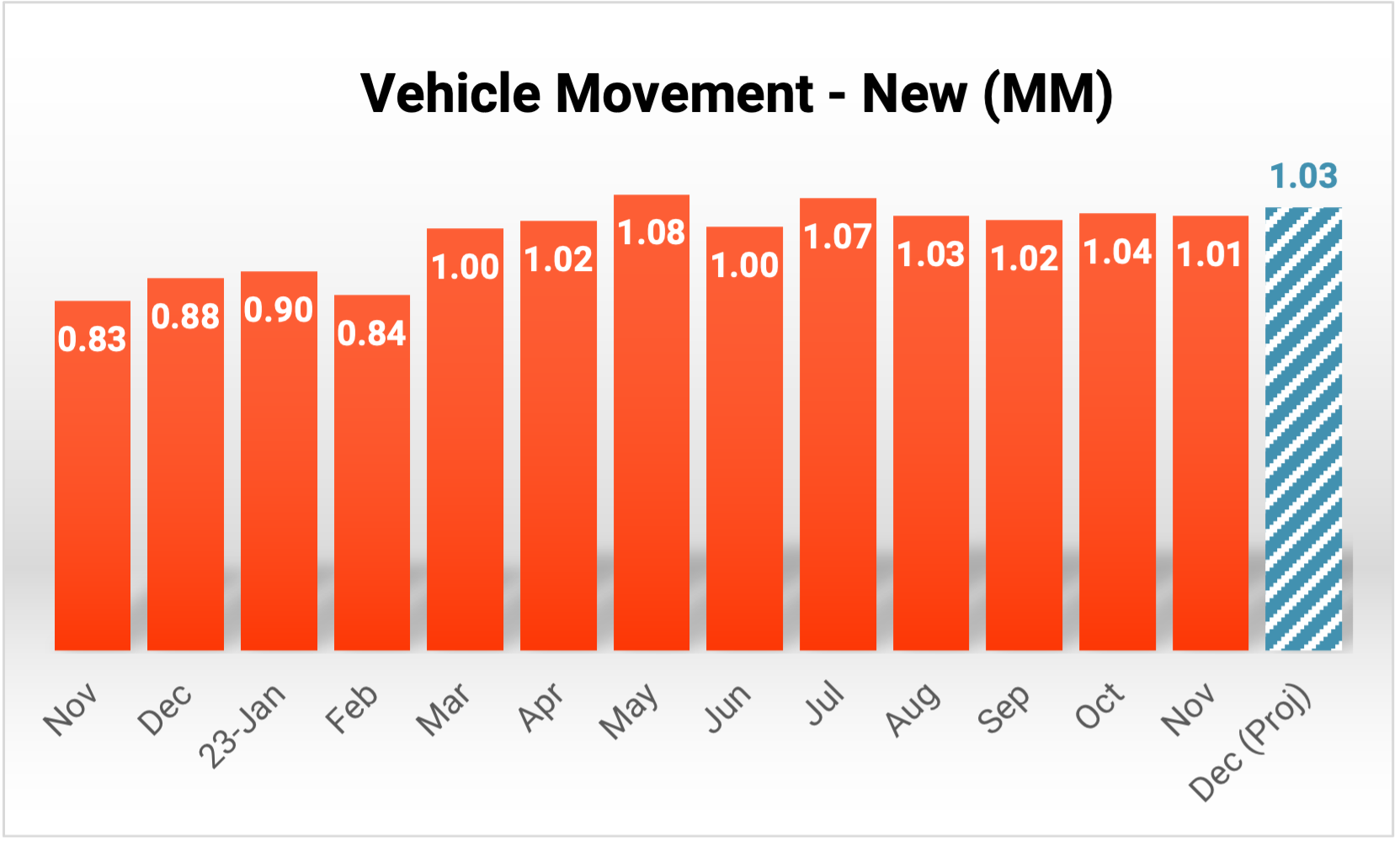

Vehicle movement fell in November, but the ZeroSum 30-day forecast predicts that December will show a slight uptick in vehicle movement to 1.03 million new cars. The static movement figures indicate that demand is not keeping pace with recent supply increases over the past several months, and the December forecast points to a continuation of that trend looking forward.

With supply increasing and demand remaining static, November turn rates dropped by three points compared to the previous month–from 44% to 41%– and fell for the fourth month in a row from a recent high of 56% in July.

Days-to-move increased for the second straight month, from 48 days in October to 51 days in the current month after holding steady at 46-47 days from January—September.

To view the full report, including used and certified vehicles, use the form below.

Fill out the form below to access the full ZeroSum's State of the Dealer Report and receive the most recent automotive trends monthly!