Driving Profits: The Importance of Data-Driven Decisions in the Used Car Market

Introduction

The used car market is witnessing a significant surge in sales. Movement has increased 16.6% vs. last year, driven partly by growing consumer confidence in pre-owned vehicles, sustained pricing differences between used and new cars, and aided by seasonal tax refunds in March and April. Current vehicle movement trends show signs of sustainability, presenting a lucrative opportunity for dealers with substantial used car inventory.

May 2024 used vehicle movement predictions from ZeroSum’s State of the Dealer monthly report.

May 2024 used vehicle movement predictions from ZeroSum’s State of the Dealer monthly report. Average used vehicle turn rate over the past year, from ZeroSum’s State of the Dealer.

Average used vehicle turn rate over the past year, from ZeroSum’s State of the Dealer.

To successfully increase used vehicle sales, dealers need to adopt strategic, data-driven approaches and know how to leverage insights effectively. This report illustrates how data enables dealers to see:

1. Which makes and models have the highest demand in a dealer’s local market

2. How much price is currently impacting turn rates

3. How to use real-time inventory and demand data to efficiently automate marketing

Vehicle Acquisition Strategy

At a broad level, data can help dealers to set their strategic prioritization as to which types of vehicles to pursue and pay more for. Doing so at a granular geographical level in real-time is crucial to ensure that vehicles have the best chance of selling in that market at that time.

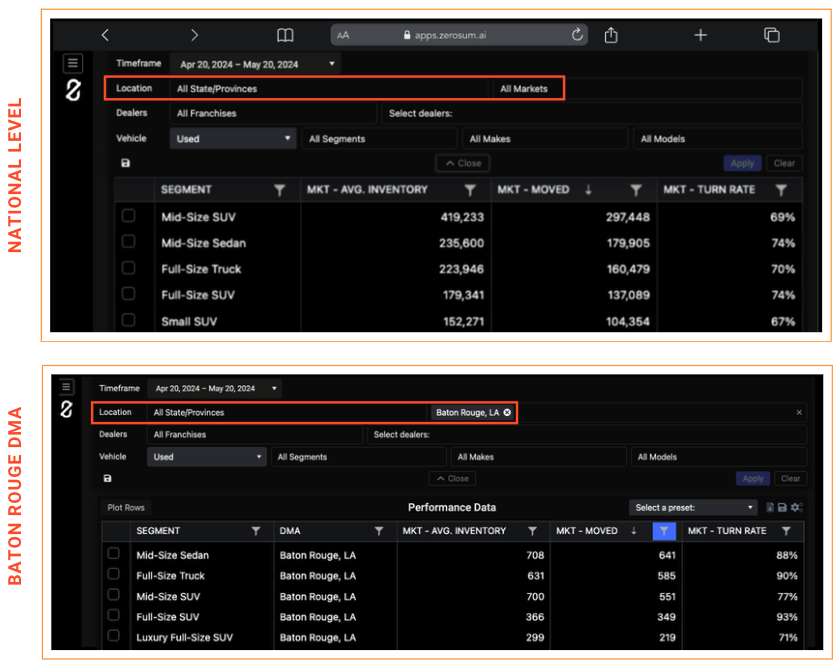

A comparison of used vehicle segment sales at a national level (top) versus the Baton Rouge DMA (bottom) is illustrative of this point.

Nationally, Mid-Size SUVs sell the best, with Mid-Sized sedans following. However, in Baton Rouge used Mid-Size Sedans and Full-Size Trucks outpace Mid-Sized SUVs. A localized and timely data-driven approach enables a dealer to pursue cars that will move efficiently and profitably.

At a more detailed level, it is essential that used car dealers know which specific vehicles to acquire via trade-ins or at auction, and those decisions should be based on what consumers are buying in their market right now. To remain competitive, a used car dealer needs information regarding what’s selling in their specific geography, and to have visibility into that information in real time.

Based on data from ZeroSum’s Market AI platform, here is a look at the top-selling used cars nationally.

Based on national data, the top three selling used car models are the Ford F-150, the Chevrolet Silverado 1500, and the Dodge Ram 1500, respectively. It is not surprising that those key models are full-size trucks, as vehicles in that segment typically appear at or near the top of the used car sales lists on a regular basis.

But knowing the top sellers at a national level is not enough. Narrowing down the geography reveals localized patterns that dealers need to make more targeted acquisition decisions.

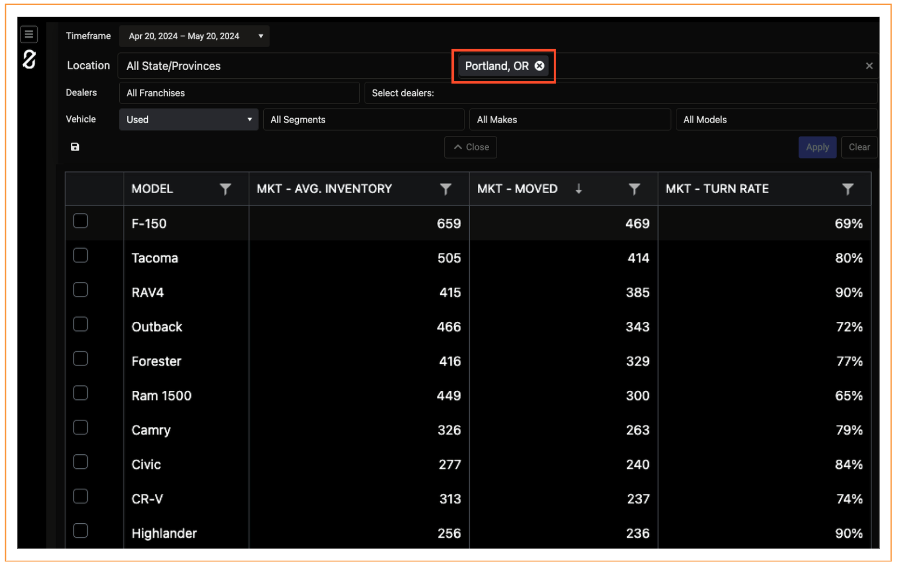

The top-selling used vehicles in Portland, Oregon, for example, reveal some similarities to the national list (most notably F-150 at the top), but there are more differences that need to be taken into account when deciding what cars to acquire or how much to pay for them.

The Silverado 1500, Equinox, Accord, and Grand Cherokee do not appear in the top 10 on the Portland list and have been replaced by two Toyota models (Tacoma and Highlander) and two Subaru models (Outback and Forester). Without this data, a dealer that relies on intuition, results only from their dealership, or delayed competitive information is missing an essential view of the dynamic landscape on which to make decisions.

Pricing Strategy

ZeroSum’s Market AI can show used car dealers the average price for every vehicle in their local market, so a dealer has, at their fingertips, a real-time view of average cost for a car and how that is affecting their efficiency in selling. Knowing the price and turn rate of specific models in a dealer’s market is valuable in driving the strategy of buying and pricing used vehicles.

Below is an example of three real car dealers in Los Angeles that sell used Honda Accords.

In this example, Dealer A has the lowest marketed price for 2021 Honda Accords and has the highest turn rate. While many other factors can affect sales efficiency (location, reputation, past experience, etc.), price is almost always a key factor in consumer decisions. Having real-time visibility into how a dealer’s pricing stacks up against the dealer across town is therefore a critical piece of data needed to stay competitive.

Marketing Strategy

MarketAI shows used car dealers how dynamic the marketplace can be and provides a technology platform to ensure that suitable cars are being marketed at the right time in a way that humans cannot keep up with.

The example below summarizes the year/make/model dynamics in the Pittsburgh, PA DMA over a fourteen-day period compared to the prior two weeks. As can be seen, an influx of 2021 F-150s and 2021 Rogues has been accompanied by a drop in turn rate for those vehicles. Meanwhile, 2022 Escapes are moving in the opposite direction.

Because these supply and demand levels shift daily, a human looking at these numbers would very likely miss this crucial information regarding inventory and turn rate. However, ZeroSum’s MarketAI, which relies on AI and machine learning to recognize and act upon these changes, ensures that a dealer’s money is being applied to the vehicles needing the most help.

By using real-time supply and demand data, dealers can match an on-lot car to a consumer who is ready to buy. MarketAI can analyze and produce data faster than any individual can, allowing used car dealers to get the most out of their investment in digital marketing. With transparent VIN-level reporting, real-time market insights, and inventory-specific digital ad campaigns, dealers know which vehicles are performing best and which ones might need a boost. MarketAI makes these changes automatically, optimizing a dealer’s advertising spend and powering seamless, inventory-specific digital ad campaigns.

Conclusion

The current landscape of the used car market shows that budget-minded consumers are keen to purchase. But just knowing which cars are selling isn’t enough for a dealer who wants a specific, data-focused marketing strategy. With access to specific information on models, turn rates, and inventory for used cars, dealers are better equipped to make smart, informed decisions and maximize their potential in the market.

As supply and demand levels shift, MarketAI provides detailed data to dealerships regarding their competition in terms of sales, inventory turn rate, and market share. From providing dealerships with data on the average selling price of similar vehicles in their market to giving dealers accurate reflections and predictions of vehicle turn rates, MarketAI gives dealers the tools to make better decisions about their inventory, pricing, and marketing strategies, leading to increased sales and profitability. Access to real-time vehicle movement, demand, supply, and pricing data is the key to increasing sales in today’s used car market.